The structure includes fees applied to certain gifts upon receipt and fees applied to certain funds held by the Leadership Foundation. The purpose of the fees is to help provide annual programming grants to the Delta Sigma Pi Fraternity and to help offset operating costs of the Foundation, including alumni relations and development efforts to increase the level of private support.

Overview of Changes

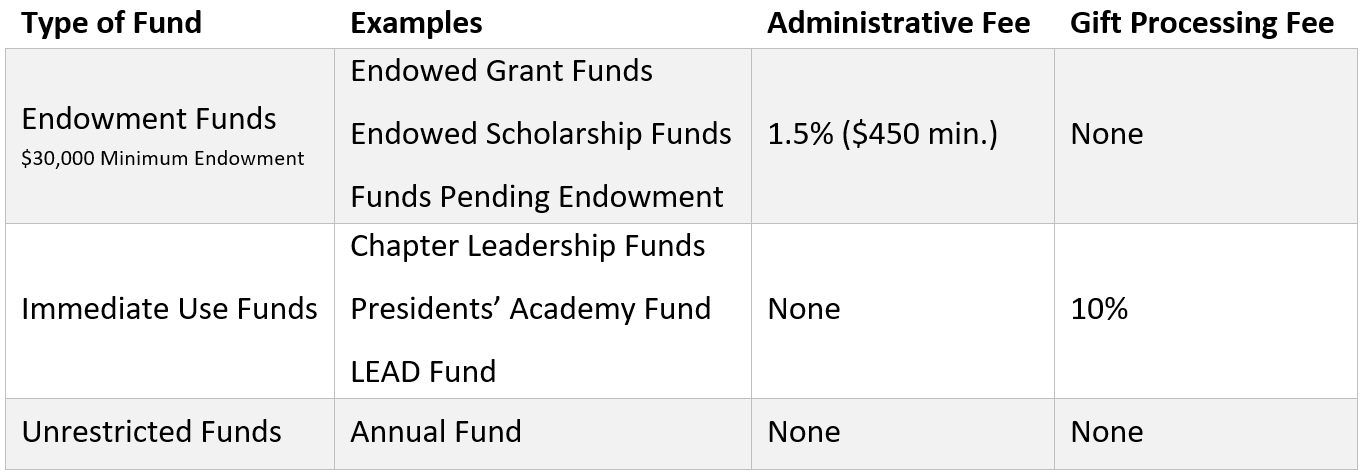

The Board of Trustees approved an updated Fee Structure Policy that established a 10 percent upfront gift processing fee for the newly created immediate use funds such as Chapter Leadership Funds and the Presidents’ Academy Fund. The updated policy also increases the annual administrative fee for endowment funds from 1.25 percent to 1.5 percent.

Endowment Funds Fee

Endowment funds, including those pending endowment, will be charged an annual administrative fee of 1.5 percent of the fair market value of the fund’s assets or $450, whichever is greater, on June 30. (The $450 minimum is 1.5 percent of the $30,000 minimum endowment level approved by the Board of Trustees. The previous minimum was $375, which was 1.25 percent of the minimum endowment level.) There will be no gift processing fee charged to individual gifts to an established or pending endowment fund.

Immediate Use Funds Fee

Individual gifts to an immediate use fund will be charged a gift processing fee of 10 percent. There will be no administrative fees charged to immediate use funds

Primary Purpose of Fee Structure

As a part of fulfilling its fiduciary responsibility, the Board of Trustees established a reasonable fee structure that includes fees applied to certain gifts upon receipt and fees applied to certain funds held by the Leadership Foundation. The purpose of the fees is to help provide annual programming grants to the Delta Sigma Pi Fraternity and to help offset operating costs of the Foundation, including alumni relations and development efforts to increase the level of private support.

Types of Fees/Definitions

The fee structure utilized administrative fees and gift processing fees.

• Administrative Fee: An annual fee assessed to the total value of an endowed fund. The fee is established using a set percentage and is determined by the fair market value of a fund’s assets on June 30.

• Gift Processing Fee: An upfront fee assessed to a gift at the time of receipt. The fee is established using a set percentage. The actual transfer of monies from gift processing fees will be done upon receipt.

Key Notes from the Consulting Firm

The Leadership Foundation partnered with Bentz Whaley Flessner, one the leading fundraising consulting firms servicing many of the top universities in the country, to evaluate a number of areas related to fundraising and administration. The following information was provided:

• Based on research of current best practices and awareness of other institutions’ policies the Fee Structure is in keeping with benchmarks and norms.

• The Administration Fee (endowment funds) of 1.5 percent of the market value is almost universal and has become commonplace.

• The Gift Processing Fee of 10 percent for new, chapter-restricted funds is not out of character with similar organizations that have a similar existing endowment base and funding norms.

Process to Amend the Fee Structure

The Board of Trustees undertook a comprehensive process to evaluate and amend the Leadership Foundation’s Structure. Important notes related to the process are outlined below:

• The catalyst for the change was the creation of the new immediate use funds (Chapter Leadership Funds, Presidents’ Academy Fund and LEAD Fund). These fund types were new to the Leadership Foundation, and the previous fee structure did not easily work in the best interest of the donor or the organization.

• The Board of Trustees undertook a process to benchmark with peer organizations (fraternal, higher education and nonprofit).

• In-depth conversations and explorations with fraternal organizations with similar structure, both current and aspirational, occurred in order to explore options (mainly, Beta Theta Pi, Phi Delta Theta, Kappa Alpha Order and Alpha Kappa Psi).

• The Leadership Foundation’s (contracted) fundraising consultant, Jeffrey A. Hilperts from Bentz Whaley Flessner, worked with the Board of Trustees and staff to evaluate Fee Structure options.

• A Fee Structure Task Force was established to evaluate options. This Task Force unanimously recommended the Fee Structure to the Board of Trustees.

FEE STRUCTURE FAQ

Are gifts to the new funds fully tax-deductible?

All gifts to the Presidents’ Academy Fund, the LEAD Fund and Chapter Leadership Funds are tax-deductible (as allowable by law). A fee assessed to a gift or Fund does not factor into the tax-deductible amount of the donor’s contribution. Therefore, 100 percent of all gifts are tax-deductible.

Do gifts to the immediate use Funds, such as Chapter Leadership Funds, count toward the lifetime giving total of a donor?

All gifts to the Presidents’ Academy Fund, the LEAD Fund and Chapter Leadership Funds are included in the donor’s annual and lifetime giving records.

Will currently established Endowment Funds be assessed the 1.5 percent Administrative Fee?

All established Endowment Funds, and pending Endowment Funds, will follow the updated Fee Structure. The only exception is if there is specific language outlined in the original Fund Agreement. We will follow the rules set in all Fund Agreements.

Are there any exceptions or are any Funds “grandfathered” into a previous model?

Those Funds which are pending endowment and were established over four years ago were “grandfathered” into the old Fee Structure when the Fee Structure was originally amended in 2017. Those Funds will continue to be “grandfathered” at the prior rates. At the time these Funds meet the minimum, all will then follow the Fee Structure then in place.

What is the purpose of the Fee Structure?

There must be a proper balance of restricted and unrestricted revenue/donations in order to properly manage, sustain and grow the Leadership Foundation. These fees are only taken from restricted gifts and/or Endowed Funds, providing an additional revenue stream beyond unrestricted donations.

What does industry data and benchmarking tell us about our Fee Structure?

A report prepared by Bentz Whaley Flessner in 2016 shows that of 34 institutions, organizations and foundations researched, endowment fees were utilized by 29 of them. The fees ranged from .5 percent to 2.5 percent, with the vast majority being 1.5 percent. The same report indicated that of the 34 institutions, organizations and foundations participating, the fees for current use gifts were employed by a majority of them, especially for temporarily restricted gifts, such as chapter-specific funds. Those fees ranged from 2 percent to 10 percent, but the majority were between 5-7 percent.

How is the revenue from the Fee Structure utilized?

It simply allows the Leadership Foundation to sustain existing operations and to grow. It takes money to realize more money. It provides additional financial resources for the following activities and goals:

• Further funds a higher level of cultivation, solicitation and stewardship of alumni donors.

• Makes the extensive Academic Scholarship program possible – promotion, application receiving and processing, selection, verification, distribution – for dozens of awards.

• Provides additional revenue to support, and increase, the annual grant to the Fraternity (which supports all areas of education, leadership and certain academic scholarships).

• Further funds increased fundraising and marketing initiatives.

• Allows resources to evaluate and prepare for a comprehensive Capital Campaign in the near future.

• Provides opportunities to evaluate and properly (professionally) staff the Leadership Foundation.

• Makes it possible for donors to create and/or support named funds that support a particular program, passion or charitable interest.

Why did the Trustees choose 10 percent for the gift processing fee?

Our Leadership Foundation Trustees selected 10 percent, even though it is slightly on the high end, with this rationale:

We provide ample other approaches to support Delta Sigma Pi educational opportunities that do not have the 10 percent – or any fees.

We do not (yet!) have a large undesignated endowment pool (or other reserves) that allows other, longer-established institutions more leeway to fund operations.

Gift processing fees are only assessed on gifts to the immediate use Funds, such as the Chapter Leadership Funds. Such Funds require a higher level of administrative support to continuously fundraise and distribute regular grants throughout the year.

If I have further questions, whom do I contact?

You can always reach out and speak to any Trustee or staff member with questions. However, for more detailed responses, or for specific information, it is best to direct inquiries and questions to EVP Tyler Wash (tyler@dsp.org; 513-523-1907 x222).